Life Insurance in and around Saint Johns

Insurance that helps life's moments move on

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

- Saint Johns

- DeWitt

- Lansing

- Pewamo Westphalia

- Laingsburg

- Grand Ledge

- Williamston

- Okemos

- Mason

- Owosso

- Ionia

- Eaton Rapids

- Charlotte

- Potterville

- Portland

- Bath

- East Lansing

- Fowler

- Holt

- Webberville

- Fowlerville

- Durand

- Ithaca

- Leslie

Be There For Your Loved Ones

When facing the loss of a family member or a loved one, grief can be overwhelming. Regular day-to-day life halts as you prepare for funeral services arrange for burial, and come to grips with a new normal devoid of the one who has died.

Insurance that helps life's moments move on

Don't delay your search for Life insurance

Wondering If You're Too Young For Life Insurance?

Having the right life insurance coverage can help loss be a bit less overwhelming for the ones you hold dear and provide space to grieve. It can also help cover current and future needs like your funeral costs, medical expenses and retirement contributions.

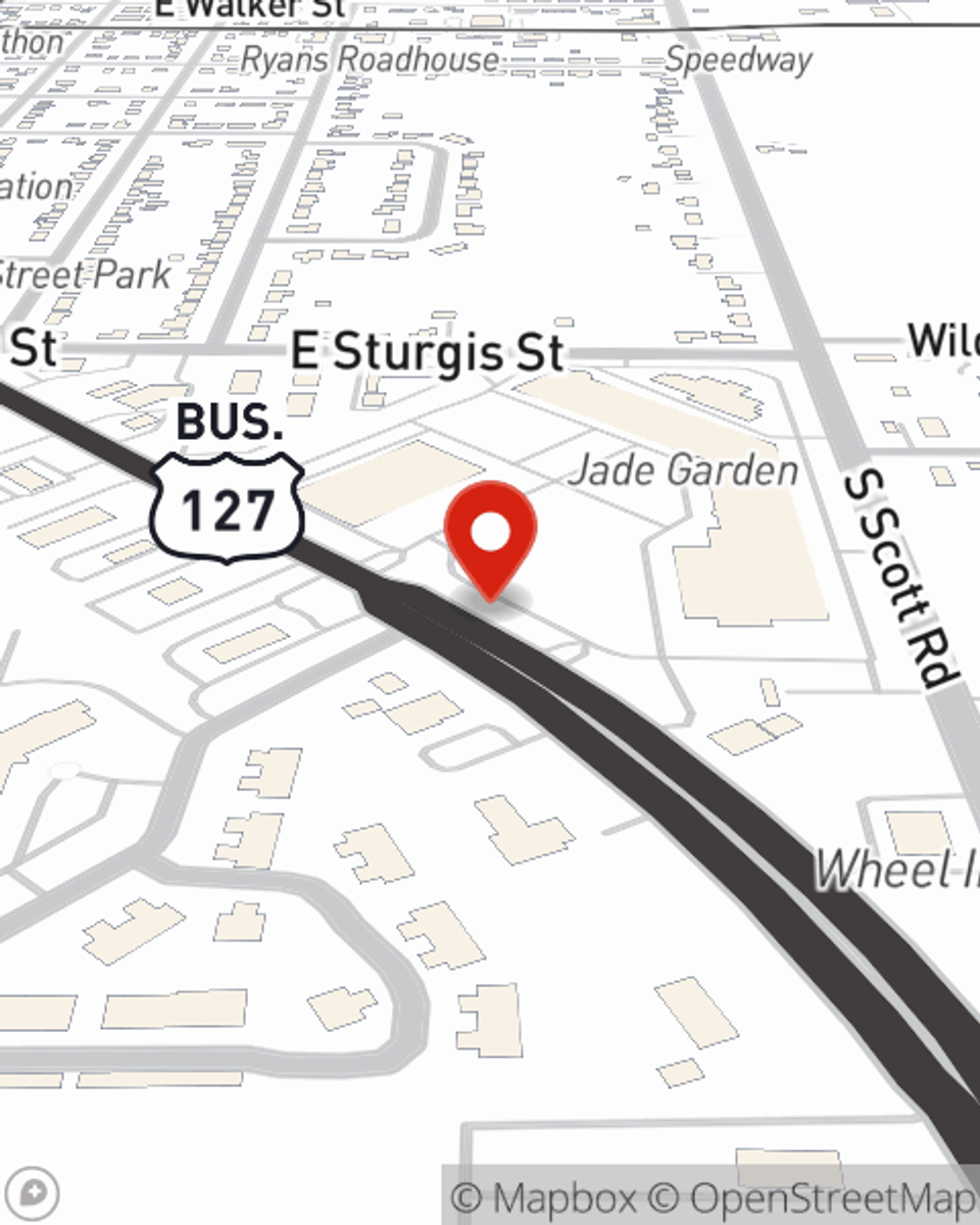

If you're looking for reliable insurance and considerate service, you're in the right place. Talk to State Farm agent Charles Schnetzler II today to discover which Life insurance options are right for you and your loved ones.

Have More Questions About Life Insurance?

Call Charles at (989) 224-7279 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What to consider when choosing a beneficiary for life insurance or other financial accounts

What to consider when choosing a beneficiary for life insurance or other financial accounts

Learn what factors to consider when choosing a life insurance beneficiary or a beneficiary for other financial accounts.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Charles Schnetzler II

State Farm® Insurance AgentSimple Insights®

What to consider when choosing a beneficiary for life insurance or other financial accounts

What to consider when choosing a beneficiary for life insurance or other financial accounts

Learn what factors to consider when choosing a life insurance beneficiary or a beneficiary for other financial accounts.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.